SCO's newly available Memorandum in Opposition to Novell's Motion for Partial Summary Judgment or Preliminary Injunction and In Support of SCO's Cross Motion for Summary Judgment or Partial Summary Judgment [PDF] has attached to it an Appendix A [PDF] and it is truly fascinating. It represents SCO's Response to Novell's Statement of Undisputed Facts. Because it lines up, paragraph by paragraph, first showing Novell's statements and then SCO's responses, I found it easier to understand the dispute between the parties. It's also less confusing than SCO's brief, which like all of SCO's filings sounds plausible if you don't happen to know a thing about the history of Unix. The dispute centers on a complex legal document, with amendments, so it's great to have this clarification. I'd like to share a few things that stood out to me. The dispute centers on whether or not SCO owed and owes Novell monies it took in from the 2003 Microsoft and Sun Microsystem agreements.

SCO's position is expressed in its opposition memo like this: The Asset Purchase Agreement ("APA") and Amendments thereto, considered as a whole, obligated Santa Cruz to remit to Novell only the binary royalties that were being paid and that would continue to be paid under the existing SVRX licenses, which Novell conveyed to Santa Cruz as part of its sale of the entire UNIX business. Let's see if that is borne out by the wording of the contract and amendments themselves, as portrayed in Appendix A.

You can find the 1995 Novell-Santa Cruz Asset Purchase Agreement, and Amendment 1 and Amendment 2 and other relevant documents on our permanent Contracts page. We also have a merged version, with colored highlights, a showing the APA and both amendments merged into one document, so you can see how it all weaves together and what changed. To complete the picture, there is also the Technology License Agreement and the Schedules to the APA. You may also want to have handy Novell's Motion for Partial Summary Judgment or Preliminary Injunction, the Memorandum in Support, SCO's Cross Motion for Summary Judgment or Partial Summary Judgment on Novell's Third, Sixth, Seventh, Eighth and Ninth Counterclaims [PDF] the Memorandum in Support of which is sealed, and Novell's Redacted Reply to SCO's Opposition to Novell's Motion for Partial Summary Judgment or Preliminary Injunction. Finally, here's SCO's Second Amended Complaint which is also referenced. See what I mean about complex? But let's see what is clear enough to any interested observer in Appendix A:.

Beginning on page 5 of Appendix A, Novell's paragraphs 12, 13 and 15 are quoted, followed by SCO's responses, which for clarity I've made blue text. Notice the red highlights in the Novell paragraphs, where I've highlighted wording that seems to me to directly contradict SCO's story about owing binary-only fees:

12. Amendment No. 1 to the APA further obliges Santa Cruz to give Novell: (1) an estimate of the total SVRX Royalties amount within six days following the calendar month when the royalties are received: and (2) a "report detailing all such royalties," within one calendar month following each calendar month in which SVRX Royalties are received by Novell. (Id., Ex. 2 at 4-6 ) § § E(f), I(1)).) "Such monthly reports shall be separately broken down by revenue type (i.e., source code right to use fees, gross and net binary per copy fees, and support fees), by product, by customer, by quarterly period by which distribution occurs, and by country .. of distribution." (Id., Ex. 2 at 4 (§ E(f)).)

Disputed to the extent the term "SVRX Royalties" includes fees other than the per-copy or binary-royalty, fees paid by licensees under SVRX licenses transferred to Santa Cruz under the APA for the distribution of SVRX products in binary form (¶¶ 6-36. 38-61).

13. The APA gives Novell the right, as the principal, to audit Santa Cruz's administration of the SVRX Royalties program. Section 1.2(b) provides that Novell "shall be entitled to conduct periodic audits of [Santa Cruz] concerning all royalties and payments due to [Novell] hereunder or under the SVRX Licenses." (Id., Ex. 1 at 2 (§ 1.2(b)).)

Disputed to the extent the term "SVRX Royalties" includes fees other than the per-copy, or binary-royalty, fees paid by licensees under SVRX licenses transferred to Santa Cruz under the APA for the distribution of SVRX products in binary form (¶¶ 6-36. 38-61)....

15. Amendment No. 1 permits Santa Cruz to retain 100% of only four narrow categories of SVRX Royalties:

(i) fees attributable to stand-alone contracts for maintenance and support of SVRX products listed under Item VI of Schedule 1.1(a) hereof;

(ii) source code right to use fees under existing SVRX Licenses from the licensing of additional CPU's and from the distribution by Buyer of additional source code copies;

(iii) source code right to use fees attributable to new SVRX licenses approved by Seller pursuant to Section 4.16(b) hereof; and

(iv) royalties attributable to the distribution by Buyer and its distributors of binary copes of SVRX products, to the extent such copies are made by or for Buyer pursuant to Buyer's own licenses from Seller acquired before the Closing Date through Software Agreement No. SOFT-000302 and Sublicensing Agreement No. SUB-000302A.

(Id., Ex. 2 at 3 (§ E(c)) (emphasis added).) Amendment No. 1 does not, however, alter SCO's duty to report the details of these SVRX Royalties to Novell. See ¶ 12, supra. Morever, Novell remains the equitable owner of all other categories of SVRX Royalties, and SCO remains obliged to "collect and pass [them] through" to Novell. (Id. at 3, 4.)

Disputed to the extent the term "SVRX Royalties" includes fees other than the per-copy, or binary-royalty, fees paid by licensees under SVRX licenses transferred to Santa Cruz under the APA for the distribution of SVRX products in binary form. (¶¶6-36, 38-61.) Disputed to the extent the term "SVRX Licenses" includes agreements other than the product Supplement (also known as product Schedules) under which Novell, like its predecessors and successors, actually licensed SVRX products. (¶¶ 6-20, 28-32, 39-75.) Disputed to the extent that the statement includes any agreement other than the SVRX licenses transferred to Santa Cruz under the APA. (¶¶ 6-20, 28-32, 39-75.) Don't you also see more than binary-only fees being owed?

If you look at Amendment 1 to the APA, furthermore, which SCO relies on, you will notice something that, on top of all the other evidence Novell presented, clashes with SCO's assertion that Santa Cruz bought Novell's Unix business "lock, stock and barrel":

Section 1.2(d), is amended in its entirety to read as follows:...

Seller represents that to its knowledge software documentation previously delivered to Buyer for the purpose of due diligence is the property of Seller, and Buyer agrees that it will destroy or return possession to Seller in New Jersey before title passes to Buyer. Why would Santa Cruz have to destroy or return documentation if it owned the business lock, stock and barrel?

We also learn a bit more about the Microsoft license:

35. As SCO confirmed publicly at the time, the 2003 Microsoft agreement "covers Microsoft's UNIX compatibility products" and licenses rights "to utilize the UNIX source code, including the right to sublicense that code." (Id., Ex. 26 (April 30, 2003 SCO Form 10Q) at 21, 22; Ex. 4 at 22; see also Ex. 27 (SCO's May 19, 2003 press release).) To that end, the Agreement grants Microsoft a release from claims and liability and a license to current Microsoft products, as well as purported rights to make, use, copy, test, service, modify, and create derivative works of certain UNIX technology, including rights to source and binary code. (Id., Ex. 11 at 1-4 ((§(§ 2.1, 2.2, 2.4, 3.5, 3.6, 4.1, 4.2, 4.4); Ex. 12 at 3-6 (Amendments No. 3, 4).)

Disputed. This statement mischaracterizes the 2003 Microsoft Agreement. (¶¶ 71-75, Part 1.E; Ex. 17 ¶¶ 16-36.) Hopefully, eventually these licenses will be made public.

Then there is the recurring issue of who SCO is, Caldera or Santa Cruz.

Notice also how SCO confuses the picture once again as it responds to Novell's paragraph 23:

23. Prior to Caldera's acquisition of Santa Cruz's Server Software and Professional Services divisions in 2001, substantially all of Caldera's revenue had been derived from sales of Llinux products and services. Caldera was unsuccessful, however, in creating a profitable Linux business. (SCO's Reply to Novell's Counterclaims, May 1, 2006 at 6 (¶ 31).)

Disputed to the extent the term "unsuccessful" is ambiguous. Caldera (like Novell and nearly all other companies) did not produce a profitable Linux business. (SCO's Reply to Novell's Counterclaims, May 1, 2006, at 6 (¶ 31).) Disputed to the extent that Caldera's revenues were affected by the unauthorized use of SCO's proprietary UNIX code and other protected materials in Linux. (Ex. 32 at 62-69 and attached Exs. 6-7.)

How, though, could Caldera, a 100% Linux company, be affected by "unauthorized use of SCO's proprietary UNIX code" in Linux? Well, it could benefit heartily, one assumes.

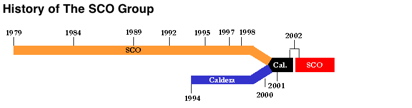

Do you remember back in 2003 when SCO put up a chart of the "history of The SCO Group"? Groklaw member Jeff Best just sent a copy to me. He'd saved it all this time for a rainy day. I think it gives us a window into SCO's thinking on who it claims to be, SCO or Caldera or both. That's something we've been puzzling over and even teasing SCO about in regards to SCO's Memorandum in Opposition to IBM's Motion for Summary Judgment on SCO's Interference Claims, in which it appears to be claiming to be the Santa Cruz Operation, saying: SCO supported its customers’ use of Linux as a complement or addition to its UNIX operating systems, but only at the customer’s request, not at SCO’s encouragement. But now it has acknowledged that as Caldera, it was a 100% Linux company and it still claims to be harmed by alleged Unix contributions it claims made Linux more desirable to the enterprise.

Here's how SCO portrayed itself back then:

Let's compare its self-portrait with the 2000 Caldera-Santa Cruz agreement, the 2001 Third Amendment, some Caldera 10-K filings, and a Tarantella 10K for 2004 describing that deal.

If you only looked at that picture and didn't know the history of Santa Cruz Operation and Caldera, you'd get the impression that The SCO Group was formed in 1979 and that Caldera merged into it sometime between 2000 and 2001. That is not what happened. The drawing is misleading and there are some missing pieces. The orange line, confusingly labeled SCO, probably should be labeled Santa Cruz Operation, to distinguish it from The SCO Group, because that is what it represents. Yes, they were also known as SCO, although not as The SCO Group. The chart makes it appear that the orange line is SCO Group, not SCO as in Santa Cruz, and that Caldera merged into it to form today's SCO Group. That isn't what happened.

Santa Cruz didn't merge with Caldera or into it or vice versa. Caldera Systems purchased two of Santa Cruz's divisions, upon which Santa Cruz renamed itself Tarantella and continued in business. Tarantella isn't represented in the timeline at all. There's no line indicating that Santa Cruz continued under the new name. So the chart is misleading in not showing that Santa Cruz, old SCO, continued as a separate entity after the two deals were complete; it did not merge with Caldera.

And where on this chart is Caldera International? It isn't labeled accurately. The blue line should be labeled Caldera Systems, Inc. and the black square should be marked Caldera International, Inc. Caldera Systems merged into what became Caldera International (and eventually is listed as a subsidiary), and Santa Cruz sold assets to Caldera Systems. Santa Cruz had three divisions, one of them being Tarantella, and after the deal with Caldera, that division kept on chugging along as a new corporate entity, as you've seen. Companies usually are more likely to tell the SEC the truth, even if they fudge elsewhere, so what did the SCO Group tell the SEC it used to be, Caldera International or Caldera Systems or Santa Cruz or a blend of the latter two? If you search for "Caldera" on www.sec.gov, here's what you get: 0001102542 SCO GROUP INC UT

SIC: 7372 - Services-Prepackaged Software

formerly: CALDERA INTERNATIONAL INC/UT (filings through 2003-05-15)

CALDERA SYSTEMS INC (filings through 2000-08-11)

Clear enough for you? The SCO Group isn't listed as formerly Santa Cruz. It used to be Caldera International, Inc., and before that, until August 11, 2000, it was known as Caldera Systems.

The press release announcing the second part of the deal between Santa Cruz and Caldera in 2001 had quotations from the two CEOs, and as you'll see, Taratella's CEO intended to keep right on: Ransom Love, president of Caldera Systems, commented, "With the SCO OpenServer technology purchase, Caldera will not only have created the first and largest combined UNIX and Linux channel, it will be able to provide all current SCO Server Software Division customers with new and existing solutions from one source. The purchase further simplifies Caldera's internal administration, roadmap control and communication, allowing better service to its customers."

Doug Michels, CEO of SCO said, "I am pleased that the simplification of the transaction will help SCO achieve its goal of creating a pure-play company focused on our Tarantella products. The overall consideration and increased cash component will enable us to proceed with our plan to reinvent ourselves around our Tarantella business and drive Tarantella, Inc. to be the leading provider of web-enabling software." And you can verify this is what happened in Caldera International's 10-K for the fiscal year ended October 31, 2001 and filed January 18, 2002, which places it post the deal with Santa Cruz, in which Caldera wrote: "Sun, Hewlett Packard, IBM,

Tarantella (formerly The Santa Cruz Operation) and others have developed a

large base of UNIX business applications to conduct internet and local

transactions." Caldera described the purchase and its new goals in that 10-K: In May 2001, we acquired the

server software and professional services groups of Tarantella, which had

employees, operations, revenue and expenses significantly greater than our

historical operations. ...In May 2001, we completed the acquisition of certain assets and operations

from Tarantella....

One of our key issues is the integration of the

business, personnel, and operations acquired from Tarantella, including the

integration of our historical Linux product offerings with UNIXWare product

offerings acquired from Tarantella. This product line integration will

involve consolidation of products with duplicative functionality,

coordination of research and development activities, and convergence of the

technologies supporting the various products.

Other business integration issues could arise, including:

o maintaining brand recognition for key products of the server business,

such as UNIXWare and OpenServer, while migrating customer identification

to our brands;...

WE HAVE NOT BEEN PROFITABLE AND WE EXPECT OUR LOSSES TO CONTINUE.

We have not been profitable. The operations recently acquired from

Tarantella have not recently been profitable and their revenue has been

declining....

As a result of the acquisition of the operations from

Tarantella, we expect to continue to incur net losses because those operations

have incurred losses in the recent past and we anticipate incurring expenses in

connection with the integration of the businesses, developing our products,

expanding our market reach, building awareness of our brand and integrating the

products formerly offered by Tarantella....

IF THE MARKET FOR LINUX BUSINESS SOLUTIONS DOES NOT GROW AS WE ANTICIPATE, WE

MAY NOT BE ABLE TO CONTINUE OUR BUSINESS PLAN AND GROW OUR BUSINESS.

Our strategy for marketing Linux solutions to businesses depends in part

upon our belief that many businesses will follow a trend away from the use of

networked computers linked by

centralized servers and move toward the use of distributed applications

through thin appliance servers, or specialized servers, Internet access

devices and application service providers. We also are relying on electronic

solution providers making these technologies available on Linux and Linux

then becoming a desirable operating system under these circumstances.

However, if businesses, which at present favor Microsoft and other non-Linux

operating systems, do not adopt these trends in the near future, or if Linux

is not viewed as a desirable operating system in connection with these

trends, a significant market for our products may not develop. The SCO Group's chart in no way indicates this historic reality: SCO Group isn't Santa Cruz. Tarantella is. Here's how Tarantella tells its own story, in its 10K for the fiscal year ended September 30, 2004:

Note 14—Transactions with Caldera

On May 4, 2001, we consummated the sale of our Server Software and Professional Services divisions to Caldera Systems, Inc. Under the terms of the transaction, Caldera Systems, Inc. acquired the assets of the Server and Professional Services groups. A new company, Caldera International, Inc. (“Caldera International”), was

formed which combined the assets acquired from us with the assets of Caldera Systems, Inc. Upon the completion of the sale, we continued to operate our Tarantella business, and accordingly, changed we corporate name to Tarantella, Inc. and our trading symbol to TTLA to reflect the new corporate name. We were subsequently de-listed from the Nasdaq and our trading symbol is now changed to TTLA.OB

As consideration for the transaction, we received 16 million common stock shares of Caldera International (representing approximately 28.2% of Caldera International), $23 million in cash (of which $7 million was received on January 26, 2001) and a non-interest bearing promissory note in the amount of $8 million that was originally to be received in quarterly installments of $2 million beginning in August 2002.

As part of the original transaction, if the OpenServer line of business of the Server and Professional Services groups generated revenues in excess of specified thresholds during the three-year period following the completion of the combination, we had earn-out rights entitling us to receive 45% of these excess revenues. The transaction was treated as a disposal of Server and Professional Services groups and a gain of $53,267,000 was recorded upon completion of the transaction.

For the fourth fiscal quarter of 2001, our operating results included 28.2% of the operating results of Caldera International, adjusted for amortization of 5 months of negative goodwill of approximately $0.7 million. The net amount of the losses included was $4.6 million. In the fourth fiscal quarter of 2001, we also recorded an impairment of the investment, net of the remaining negative goodwill of $7.8 million, in the amount of $22.5 million. The impairment was recorded as the share price of Caldera International was significantly below the fair market value of Tarantella’s and was deemed to be other than temporarily impaired.

During the first fiscal quarter of 2002, our net loss included equity losses of $4.0 million for our share of Caldera International losses. After recording this loss, the carrying value of the shares of Caldera International stock was reduced to zero, in accordance with APB opinion No. 18, “The Equity Method of Accounting for Investments in Common Stock.”

During the second quarter of fiscal 2002, the Company signed an agreement with Caldera International to redeem the $8 million note receivable held by the Company for $5 million. The note was originally payable in four quarterly installments of $2 million each, beginning in August 2002. A loss of $3,038,000 was recorded against the gain on the sale of divisions to Caldera for the redemption of the note receivable.

Additionally, Caldera International agreed to the buyout of certain licenses for products bundled in older releases of The Santa Cruz Operation, Inc.’s software, and the buyback of 500,000 post split shares of Caldera International stock held by us for $555,000. On March 7, 2002, Caldera International executed a 1 for 4 reverse stock split. Accordingly, the shares held by us were adjusted to reflect the stock split.

During the third quarter of fiscal 2002, Tarantella announced an agreement with Caldera International for Caldera International to repurchase the remaining 3,289,401 shares of Caldera International common stock held by Tarantella. Tarantella recorded other income of $3,059,250 from this transaction in the third fiscal quarter and subsequently received the cash in July 2002. For the fiscal year ended September 30, 2002, we sold 4,010,417 post split shares of Caldera International stock for total proceeds of $4,360,938. As of September 30, 2002, we did not own any securities in Caldera International. During the third quarter of fiscal 2002, Caldera International also bought out the remaining term of the OpenServer revenue sharing plan that was part of the original transaction, for $100,000, which was recorded as a gain on the sale of divisions to Caldera. In addition, royalty reserves of $345,000 related to the original transaction were written off and recorded as a gain on the sale of divisions to Caldera.

See what I mean? Both Santa Cruz and Caldera Systems had assets that went to what became a brand new corporate entity, Caldera International, Inc. Interestingly, this 2000 amendment to a contract with Esnet specifies that Caldera Systems, Inc. is the "successor-in-interest" to Caldera, Inc. And an interesting footnote to history can be found in Caldera Systems, Inc.'s 10-K/A for the fiscal year ended October 31, 2000, and it talks about the then-in-the-works deal: PROPOSED AGREEMENT TO ACQUIRE THE SANTA CRUZ OPERATION, INC. SERVER AND

PROFESSIONAL SERVICES DIVISIONS

In August 2000, we entered into a reorganization agreement with The

Santa Cruz Operation, Inc., or SCO. The reorganization agreement provides for a

combination in which Caldera International, a new entity, would purchase SCO's

server and professional services groups by issuing to SCO and its employees who

join Caldera International approximately 18.2 million shares, or approximately

28.6% on a fully diluted basis, of Caldera International's common stock

(including approximately 2.0 million shares reserved for employee options

assumed or replaced by Caldera International for options currently held by SCO

employees joining Caldera International) and paying $7 million cash to SCO. In

the combination, each share of Caldera Systems common stock would be exchanged

for a share of Caldera International common stock.

The server and professional services groups of SCO operate as a

provider of server software and related support for networked business

computing, and is a leading provider of UNIX server operating systems through

their UnixWare line of products. If the combination closes, Caldera International will have a new strategy based upon the

integration of Unix and Linux products into broad-based business solutions. It

is currently not known if and when the combination will occur. The closing of

the combination remains subject to ongoing regulatory review and approval by the

shareholders of SCO and the stockholders of Caldera.

In conjunction with the signing of the reorganization agreement,

Caldera and The Canopy Group, Inc., our majority stockholder, agreed to loan to

SCO $7 million and $18 million, respectively. If the combination is completed,

our advance to SCO would be forgiven and would be treated by Caldera

International and SCO as the cash portion of the consideration to SCO for the

server and professional services groups. On January 26, 2001, we loaned the

$7.0 million to SCO....

So, um, who paid whom? And after reading all this,

exactly who is The SCO Group? For sure it was Caldera International, Inc., prior to the name change, and Caldera Systems merged into that. I really don't understand how it claims to be Santa Cruz. It merely entered into a transaction with it to purchase some assets. After all, when Santa Cruz acquired Unix technology from Novell in 1995, that didn't turn Santa Cruz into Novell, did it?

To show you what I mean, here's a brief company history from that Tarantella 10K, and as you will see, Tarantella claims to have been Santa Cruz formerly. How can Tarantella and SCO Group both be Santa Cruz? Brief Company History -

1979 Doug Michels and Larry Michels co-found The Santa Cruz Operation, Inc.

- 1986 Company expands into Europe—acquisition of a division of Logica, UK.

- 1987 Agreement with Microsoft to license XENIX.

- 1992 Launch of SCO OpenServer product.

- 1993 Acquisition of IXI, Ltd. for client integration technology.

- 1993 Company goes public on Nasdaq Stock Market, trading as SCOC.

- 1994 Acquisition of Visionware, Ltd., for client emulation technology.

- 1995 Acquisition of UNIX technology from Novell.

- 1997 Launch of the Tarantella product.

- 1998 Launch of UnixWare7 product.

- 2001 Release of Tarantella Enterprise 3 software.

- 2001 Sale of Server Operating System division and the Server Professional Services division to Caldera Systems, Inc.

- 2001 Company changes name to Tarantella, and changes trading symbol to TTLA.

- 2003 Acquisition of New Moon Systems, Inc. for Windows-based products expertise.

- 2003 Tarantella completes a private placement raising gross proceeds of approximately $2.3 million.

- 2003 Tarantella de-listed from Nasdaq and begins trading as TTLA.PK.

- 2004 Tarantella rebrands product line as part of business restructuring strategy.

- 2004 Tarantella completes two private placements raising gross proceeds of $19.1 million.

- 2004 Tarantella begins trading as TTLA.OB.

As you can see, the Tarantella product line continued right on after the deal, and so did Santa Cruz, as Tarantella. The 2000 reorganization agreement makes a definite distinction between "the Caldera merger" and "the SCO transaction". Let's take a look at the agreement: AGREEMENT AND PLAN OF REORGANIZATION

THIS AGREEMENT AND PLAN OF REORGANIZATION (this "Agreement") is

entered into as of August 1, 2000, by and among Caldera Systems, Inc., a

Delaware corporation including for all purposes Caldera Surviving Corporation,

("Caldera"), Caldera Holding, Inc., a Delaware corporation ("Newco") and The

Santa Cruz Operation, Inc., a California corporation ("SCO"). The terms defined

in Section 13.15 of this Agreement shall have the meanings therein specified in

this Agreement. I understand that to say that the parties to the agreement are: Caldera Systems, Inc., which is defined as holding the "Caldera Surviving Corporation", and "Newco", which is a holding company for the purposes of the deal only, and The Santa Cruz Operation. It references the definitions of Section 13.15, and there it says that "Caldera Surviving Corporation" is defined in Section 1.9: 1.9 Effects of the Caldera Merger. At the Effective Time: (a) the

separate existence of Merger Sub will cease and Merger Sub will be merged with

and into Caldera, with Caldera being the surviving corporation of the Merger

(the "Caldera Surviving Corporation"), pursuant to the terms of this Agreement

and the Certificate of Merger; (b) the Certificate of Incorporation of the

Caldera Surviving Corporation shall be in the form attached as Exhibit A-1 to

the Certificate of Merger; (c) the Bylaws of Caldera immediately prior to the

Effective Time will be the Bylaws of the Caldera Surviving Corporation; (d) the

directors and officers of Caldera immediately prior to the Effective Time will

be the directors and officers of the Caldera Surviving Corporation; (e) each

share of the Common Stock of Merger Sub outstanding immediately prior to the

Effective Time will be converted into one share of Common Stock of the Caldera

Surviving Corporation; (f) each share of Caldera Common Stock, each Caldera

Option, and each Caldera Stock Purchase Plan Right outstanding immediately prior

to the Effective Time will be converted, as provided above in this Section

1.2(b). The Merger will, from and after the Effective Time, have all of the

effects provided by applicable law, including, without limitation, the Delaware

Law. "Newco" was formed by Caldera Systems, not Santa Cruz, "solely for the purpose of the transactions

contemplated hereunder". And then what happened? According to the Recitals, "a newly formed, wholly owned subsidiary of Newco

("Merger Sub") will be merged with and into Caldera, with Caldera being the

surviving corporation of such merger". OK, so Caldera survives. But what about the SCO transaction? What about Santa Cruz? "(iii) SCO and certain of its

subsidiaries as herein specified will contribute to Newco, all on the terms

herein specified, all of the Contributed Stock of the Contributed Companies

(with each of the Contributed Companies thereby becoming a wholly owned

subsidiary of Newco) and the Contributed Assets in consideration for the

issuance by Newco to SCO of shares of Common Stock of Newco, $0.001 par value

("Newco Common Stock")..." It contributed, then, certain assets, but it wasn't merged into Newco, by my reading, because there is a distinction made between "the Merger" and "the SCO Transaction" as the recitals continue: "The transactions

described in subpart (iii) and (iv) of the foregoing sentence are collectively

the "SCO Transaction." The Recitals make a distinction at the very end, again, talking about the tax consequences, which seems to be the motive behind the complexity of the deal: C. For federal income tax purposes, it is intended that (i) the

Merger qualify as a reorganization under the provisions of Section 368(a) of the

Internal Revenue Code and (ii) that the Merger and the portion of the SCO

Transaction described in Recital A (iii) above qualify as an exchange under the

provisions of Section 351 of the Internal Revenue Code. So then, if either of the original entities survived as the new corporate entity, it seems to be Caldera: 1.2 The Merger. At the Closing, subject to the terms and

conditions of this Agreement, Caldera will execute and deliver and will file

with the Secretary of State of the State of Delaware in accordance with relevant

provisions of the Delaware Law, a Certificate of Merger providing for the Merger

of Merger Sub with and into Caldera, with Caldera being the surviving

corporation upon the effectiveness of the Merger and thereby becoming a wholly

owned subsidiary of Newco, pursuant to this Agreement, the Certificate of Merger

and in accordance with applicable provisions of the Delaware Law ... SCO got stock and money, as per the "SCO Transaction" terms, but it was transacting with, not merging into, Newco. You can see that in the Excluded Assets and Excluded Liabilities sections: (i) Excluded Assets. SCO is not selling and Caldera

shall not acquire from SCO any of the following assets or any interest therein

(collectively, the "Excluded Assets"):

(A) any assets related solely to the SCO

Retained Business;

(B) any cash and cash equivalents and any

accounts receivable (the "Cash Equivalents") of the Contributing Companies and

the Contributed Companies;

(C) those assets set forth on Exhibit

1.4(b)....

(ii) Excluded Liabilities Not Assumed. Except for

the Liabilities of the Contributed Company Group (which will remain the sole

responsibility of the applicable member of the Contributed Company Group) and

except for the Assumed Liabilities expressly described above in Section 1.4(c),

Newco shall not assume, pay, perform or discharge, or otherwise have any

obligation, responsibility or liability whatsoever for, any and all Liabilities

of SCO or its direct and indirect subsidiaries (whether now existing or

hereafter arising), and said companies shall retain, and shall be solely

responsible and liable for paying, performing and discharging when due, all such

Liabilities (collectively, the "Excluded Liabilities"). And confirming my understanding of it being Caldera that survived, the tax section tells us this: 1.10 Tax-Free Reorganization. The parties adopt this Agreement

(to the extent it relates to the Merger) as a plan of reorganization and intend

the Merger to be a tax-free reorganization under Section 368(a)(1)(A) of the

Internal Revenue Code by virtue of the provisions of Section 368(a)(2)(E) of the

Internal Revenue Code. The Newco Common Stock issued in the Merger will be

issued solely in exchange for the Caldera Common Stock, and no other transaction

other than the Merger represents, provides for or is intended to be an

adjustment to the consideration paid for the Caldera Common Stock. No

consideration that could constitute "other property" within the meaning of

Section 356(b) of the Internal Revenue Code is being transferred by Newco for

the Caldera Common Stock in the Merger. The parties shall not take a position on

any tax return inconsistent with this Section 1.10. In addition, Newco hereby

represents, and will represent as of the Effective Time, that it intends to

continue Caldera's historic businesses or use a significant portion of Caldera's

business assets in a trade or business. None of the parties shall cause a

transaction, without offsetting compensation to the other party, that would

result in income to SCO under the Subpart F provisions of the Internal Revenue

Code.

1.11 Tax-Free Section 351 Transaction. The contribution and

transfer of the Contributed Stock and Contributed Assets to Newco in exchange

for Newco Common Stock, together with the Merger, are intended to constitute an

exchange within the meaning of Section 351 of the Internal Revenue Code. The

Newco Common Stock issued to SCO therein will be issued solely in exchange for

the Contributed Stock and Contributed Assets transferred in

the SCO Transaction and no consideration (other than the cash consideration)

that could constitute other property within the meaning of Internal Revenue Code

Section 351(b) is being transferred by Newco to SCO. The parties shall not take

a position on any tax return inconsistent with this Section 1.11. Those contributed assets are elsewhere designated as "Contributed Companies and the Contributed Subsidiaries". I think it's on that basis that SCO Group may be claiming a Santa Cruz tie in. But that Santa Cruz, old SCO, continued on, can be seen in these definitions:

"Group Assets" shall mean the Contributed Assets and all

Contributed Company Property, considered collectively.

"Group Benefit Arrangements" is defined in Section 2.8(a).

"Group Business" means the business of SCO and its direct and

indirect subsidiaries with respect to (i) the Group Products, as reflected in

the 2000 Group Balance Sheet, including without limitation the business of

developing, manufacturing, marketing, licensing, distributing, using, operating,

installing, servicing, supporting, maintaining, repairing or otherwise using or

commercially exploiting all or any aspect of any or all of the Group Products or

of any Intangible Assets or Intellectual Property Rights related to any of the

Group Products, and (ii) the professional services division, but excluding the

SCO Retained Business....

"SCO Retained Business" means the business of SCO that does not

constitute the Group Business consisting of the Tarantella business. So, how SCO Group claims to be Santa Cruz is a mystery to me. Speaking of mysteries, there have been rumors of layoffs at SCO. We'll find out at the January financial conference call, presumably. For comparison, I thought you'd enjoy some historic employee counts from the two Caldera 10-Ks. Before the deal was consummated, Caldera had 178 employees: As of October 31, 2000, we had a total of 178 employees. Of the total

employees, 63 were in software engineering, 50 in sales and marketing, 19 in

customer service and technical support, 11 in operations and 35 in finance and

administration. And after the purchase, Caldera listed 545 employees: As of October 31, 2001, we had a total of 545 employees. Of the total

employees, 146 were in software engineering, 117 in sales, 58 in marketing, 87

in customer service and technical support, 34 in customer delivery, and 103 in

administration. One final point gleaned from the 10-K for 2001. SCO has accused IBM of making contributions to Linux in 2000 onward with the goal of destroying SCO's UNIX business. Quite aside from the fact that Caldera, now SCO Group, had no Unix business until 2001, I noted this in the older 10-K/A: We have business alliances with key global industry partners, including

Citrix Systems, Fujitsu, IBM, Intel, Novell, Oracle and Sun Microsystems. These

relationships encompass product integration, two-way technology transfers,

channel partnerships and revenue generating initiatives in areas of product

bundles, training and education, consulting and third-level technical support

for our partners. The objectives of these partnerships include:

- providing complete hardware and software Linux solutions;

- licensing our education materials to be used in our partners' training

centers;

- supporting our partners' Linux engineering efforts as well as their

end-user customers; and

- mutually developing our sales and distribution channel by coordinating

marketing initiatives in creating demand for our products.

In November 1999, we entered into a contributor agreement with Intel to

port OpenLinux products, including OpenLinux eServer, to Intel's IA64 platform.

In addition we will be porting the Java Development Toolkit and Java Runtime

Environment to the IA64 platform.

How was IBM harming Caldera by making Linux better? It was in an alliance to do exactly that and had every reason to think that it was in fact helping its Linux partner.

Significantly, in Appendix A, on page 9, The SCO Group acknowledges the chain of beingness:

D. The Sale of UNIX Assets from Santa Cruz to Caldera; Caldera's

Name Change to SCO

19. Approximately five years after execution of the APA, on August 1, 2000, Caldera Systems acquired Santa Cruz's Server Software and Professional Services divisions.... The Server Software division included Santa Cruz's UNIX-related business....

Undisputed.

20. On May 7, 2001, Caldera International ("Caldera") was formed as a holding compnay to own Caldera Systems, including the assets, liabilities and operations of Santa Cruz's Server Software and Professional Services divisions....

Undisputed.

21. On August 26, 2002, Caldera announced that it would change its name to The SCO Group, Inc. ("SCO"), pending shareholder approval; on or about that time, Caldera began doing business as SCO....

Undisputed.

22. SCO claims to be the successor-in-interest to Santa Cruz's rights and obligations under the APA. (SCO's Second Amended Complaint, Feb. 3, 2006, at 22 (¶ 88).)

Undisputed.

Based on what is SCO claiming to be successor-in-interest to Santa Cruz? IBM has revealed in its Memorandum in Support of its Motion for Summary Judgment of SCO's Unfair Competition Claim (SCO's Sixth Cause of Action) , that the Project Monterey contract was not passed on from Santa Cruz to Caldera. Under the contract, Santa Cruz was supposed to get IBM's written consent to any assignment of the agreement in a change of control. It failed to do that, and IBM sent a letter in June of 2001, stating that IBM did *not* consent to the contract being assigned to Caldera:

31. Santa Cruz did not obtain IBM's prior written consent to an assignment of the JDA. Instead, Santa Cruz informed IBM of the sale of its Server Software and Professional Services divisions and its UNIX-related assets to Caldera in a letter dated June 6, 2001.(Ex. 244.)

32. IBM declined to consent to the assignment of Santa Cruz's rights and obligations under the JDA. Pursuant to Section 22.12 of the JDA, IBM's consent was necessary for such assignment to take effect. On the contrary, IBM invoked its right to cancel the JDA under Section 15.2 in a letter dated June 19, 2001. (Ex. 220.) If SCO can prove it owns the copyrights to Unix, of course then it would be successor-in-interest to those copyrights, but Novell says the copyrights never passed to anyone and it also claims the right to waive IBM and Sequent breaches to their AT&T contracts, so SCO's claim to be the successor-in-interest would be what? On page 3 of its memo, SCO writes that "Novell sold the entire UNIX business to Santa Cruz under the APA." Page 5 qualifies that to assert that "Novell retained a limited interest in the binary royalties due under existing SVRX licenses." Is that what Appendix A says to you? If I were SCO, I'd urgently want to prove that I was the successor-in-interest to Santa Cruz, but I don't see how it will do so. I would be worrying that some folks might have invested based on representations and on the suggestions in that chart if they don't turn out to match the facts. But I have provided you with all the materials now, so you can reach your own conclusions. What does Appendix A show you? Does it match up with what SCO claims in its Second Amended Complaint? 31. SCO is the sole and exclusive owner of all Software and Sublicensing Agreements that control use, distribution and sublicensing of UNIX System V and all modifications thereof and derivative works based thereon. SCO is also the sole and exclusive owner of copyrights related to UNIX System V source code and documentation and peripheral code and systems related thereto. If you are interested in what "successor-in-interest" means in the law, here's a ruling from the U.S. Court of Appeals for District of Columbia Circuit that happens to discuss it, because it was a point of contention: The trustees urge a broad definition of successors in interest, namely the "substantial continuity of operations test."

This is a multi-factor inquiry that examines, among other

things, the ability of the predecessor to provide relief; wheth-

er the new employer had notice of potential liability; whether

he uses the same plant, equipment and workforce; and

whether he produces the same product. See, e.g., Secretary

of Labor v. Mullins, 888 F.2d 1448, 1453-54 (D.C. Cir. 1989).

Under this standard, the companies may well be successors in

interest to Toney's Branch: Toney's Branch is now bankrupt,

the Act is familiar to all coal operators, and the companies

seamlessly took over operations at Shumate Eagle.

Against this the companies urge narrower definitions,

drawn both from general corporate law and from federal tax

law (noting that the Act is in fact embedded in Title 26, the

Internal Revenue Code ("I.R.C.")). Black's Law Dictionary

(6th ed. 1990), for example, provides the standard corporate

law definition:

In order to be a "successor in interest", a party must

continue to retain the same rights as original owner

without change in ownership and there must be change

in form only and not in substance, and transferee is not a

"successor in interest." ... In case of corporations, the

term ordinarily indicates statutory succession as, for

instance, when corporation changes its name but retains

same property.

Id. at 1283-84 (citations omitted). In the alternative, the

companies suggest a definition from the I.R.C. that shares

with the corporate law definition the element of commingled

ownership. See 26 CFR s 1.1503-2A(c)(3)(vii)(B); 26 U.S.C.

s 381. Under both of these definitions the "successor in

interest" is a successor to the wealth of the predecessor,

typically through a corporate reorganization. A party simply

acquiring property of a firm in an arm's length transaction,

and taking up its business activity, does not become the

selling firm's "successor in interest." Under both definitions

the companies are plainly not successors in interest of Toney's Branch, and we need not here wrestle with which of

them is to be preferred in the event of a clash.

It's more complex [PDF] than this indicates, in that Utah and California law would likely also need to be researched, but do you see why Novell tends to use the phrase "alleged predecessor-in-interest"?

|