|

|

| Dorsey & Whitney File 6th Monthly Bill in SCO Bankruptcy - SCO Global - Updated |

|

|

Wednesday, May 14 2008 @ 04:15 AM EDT

|

I mentioned that I have been trying to figure out why SCO's corporate law firm, Dorsey & Whitney, in their sixth monthly bill is seen working on corporate documents for SCO Global, Inc. On March 18, 2008 of the bill's Exhibit D, we see on page 5 of the PDF a notation that paralegal C. Peters organized "corporate records files SCO Global, Inc.":Organize corporate records files SCO Global, Inc. (1.25), review disclosure schedules and e-mail messages from client concerning disclosure schedules (.3); discuss schedules with D. Marx and update schedules according to conversation with same (1.3) What is SCO Global? Why now? And why does SCO Global keep cropping up?

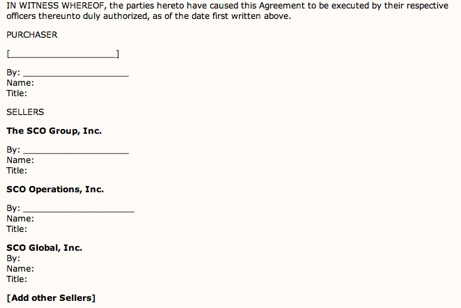

I first noticed SCO Global's corporate documents mentioned in Dorsey & Whitney's first bill, and I asked at the time what SCO Global does, but I didn't follow through. This time, I did. After following the thread as far as I can, it seems that at a minimum, SCO Global is one of the US subsidiaries that SCO wants to sell, as you can see by the now withdrawn York deal's proposed and withdrawn ABA, where it is listed as a signatory Seller. I'll show you what I've found.

Here is a screen capture of the signature line:

I wonder how I didn't notice it before now.

Again, here are the filings for the Dorsey bill:

471 - Filed & Entered: 05/09/2008

Application for Compensation

Docket Text: Monthly Application for Compensation Sixth Monthly Fee Application of Dorsey & Whitney LLP for the Period March 1, 2008 through March 31, 2008 Filed by Dorsey & Whitney LLP. Objections due by 5/29/2008. (Attachments: # (1) Exhibit A # (2) Exhibit B # (3) Exhibit C # (4) Exhibit D # (5) Notice of Sixth Monthly Fee Application) (Schnabel, Eric)

SCO Global

So what precisely is SCO Global, Inc.? If we go to our friend Google, we find that it was listed as a subsidiary of SCO Group, Inc. back in 2002 in a SCO Group, Inc. 10K for 10/31/02. Formerly, in the year 2001, which is when it seems to have started. since you don't see it on the list in 2000, it was called Caldera Global, Inc. and the notations say it's a wholly owned "US Company". Here's the latest list of subsidiaries, as of 10/31/07 anyway, of SCO subsidiaries, and we see SCO Global on the list:

SCO Operations, Inc. -

United States - Wholly owned

SCO Global, Inc. -

United States - Wholly owned

SCO Software (UK) Ltd. =

United Kingdom - Wholly owned

SCO Japan, Ltd. -

Japan - Wholly owned

SCO Canada, Inc. -

Canada - Wholly owned

The SCO Group (Deutschland) GmbH -

Germany - Wholly owned

The SCO Group (France) Sarl -

France - Wholly owned

SCO Software (India) Private Ltd. -

India - Wholly owned

ME Inc. - United States - Wholly owned

Cattleback Intellectual Property Holdings, Inc. -

United States - Wholly owned

I don't see SCO China, and that's because it's a joint venture, not a subsidiary, I gather: In connection with the Company’s acquisition of the server and professional services groups from The Santa Cruz Operation, it acquired a 30 percent ownership interest in SCO Software, China; a joint venture in China. This investment is being accounted for using the equity method. As of October 31, 2007, the Company’s investment balance in SCO Software, China was $497,000, which is included other assets. Me Inc. is now listed as a wholly owned subsidiary, as you see. You'll recall that Darl McBride told the U.S. Trustee's trial attorney at the October 341 Creditors' Meeting about Me Inc.: McMahon: Exhibit 18A references Me Inc. Was that an entity formed by the Debtors, or is that an aquisition?

McBride: That was formed by us, it's a wholly owned sub.

McMahon: What was its business purpose? What is its business purpose?

McBride: Its business purpose is basically an entity to put our mobility assets into. To date, we haven't actually transferred those in there, but it is set up, it is the, the marketing tag-line, if you will, a marketing moniker for our mobility product line. But, because we don't have substantial amount of revenue flowing there yet, we have not gone through the process yet of moving all the assets in to Me Inc. But that is the, that has been and continues to be the plan. So right now the assets of Me Inc and the liabilities of Me Inc are just booked under Operations.

(87:50)

Spector: May I inquire, booked under Operations or under Group?

Acheson: Well, it's in the same set of books with Operations...

McBride: It rolls up under Operations...

Acheson: It's a U.S. entity.

McBride: But the longer term plan would be to split it off from Operations, and at that point it would report into Group. I mean, the entity reports into Group right now, but I'm just saying the operations and people and the operations of the mobility product lines are still held under Operations. And part of what we'd be trying to do going forward from a reorganization standpoint would be to place more emphasis on this.

Here's the list of subsidiaries that Darl McBride listed when SCO first filed for Chapter 11 bankruptcy: In addition to Operations, SCO Group has the following subsidiaries located both in and outside the United States as follows:

a. SCO Global, Inc. (U.S.);

b. Me, Inc. (U.S.);

c. Me Software Limited (U.S.);

d. Cattleback Holdings, Inc. (U.S.);

e. SCO Canada, Inc. (Canada);

f. SCO Software (UK) Ltd. (United Kingdom);

g. SCO Japan, Ltd. (Japan);

h. The SCO Group (Deutschland) GmbH (Germany);

i. The SCO Group (France) SarI (France); and

j. SCO Software (India) Private Ltd. (India). The list keeps changing. I don't know what happened to Me Software Limited. Poof.

But I gather from all I've found that this is why Dorsey & Whitney is working on its corporate documents -- because SCO Global is part of whatever SCO keeps trying to hand off. It was part of the York deal that was withdrawn, and apparently it is still part of what SCO is trying to now sell to the Stephen Norris folks. None of the above tells us what SCO Global is or what it does. It is tempting to lean to the thought that it is the services part of their business. SCO press releases, like this example from 2005, usually included this line: "SCO Global Services provides reliable localized support and services to partners and customers." This old press release mentions that "SCO Global Services is a service mark of Caldera International, Inc." I can't resist pointing out that you'll note that it also says "UNIX and UnixWare, used under an exclusive license, are registered trademarks of The Open Group in the United States and other countries," just as a little footnote to history. I think it is likely, then, that SCO Global is the services end, but I don't know it as a fact. After all, Santa Cruz Operation also had back in 1994 something called SCO Global Access, according to this press release reproduced on Interesting People: WICHITA, KS AND SANTA CRUZ, CA, SCO FORUM94 (August 22, 1994) --

(NASDAQ:SCOC) In a revolutionary spin on business use of the

Information Superhighway, The Santa Cruz Operation, Inc. (SCO)

and Pizza Hut, Inc. today announced "PizzaNet," a pilot program

that enables computer users, for the first time, to

electronically order pizza delivery from their local Pizza Hut

restaurant via the worldwide Internet.

Pizza Hut will launch the PizzaNet pilot in the Santa Cruz area

on August 22 and use it to study the feasibility of expanding the

program to other cities in the U.S. and around the world.

Technology for the pilot program includes the SCO Global Access

product, an integrated Internet business server solution. The SCO

Global Access incorporates advanced NCSA Mosaic software for

browsing the Internet, and the custom "PizzaNet" application

software developed by SCO's Professional Services organization.

"The worldwide Internet, along with SCO Global Access software,

present us with exciting new opportunities to offer home delivery

services to our customers," said Jon Payne, Pizza Hut MIS

Director of POS Development. "The PizzaNet pilot will help us

study the technical feasibility and gauge customer response to

these new services, while taking an important step toward

integrating our restaurants with the Information Highway."

To participate in the PizzaNet Pilot, customers in the Santa Cruz

area need computers with Internet access and any version of

Mosaic, such as Windows, Mac, or UNIX. Customers use the

Internet's World Wide Web to access the centralized PizzaNet

server at Pizza Hut Headquarters in Wichita, Kansas. This 486

system runs SCO Open Server and SCO Global Access software, using

the Mosaic and Hypertext Transfer Protocol to present customers

with a customized menu page for ordering pizza deliveries. Mosaic

is widely used at many technology companies, government agencies,

and universities. It is rapidly being adopted by many business

and home users in response to the continuing availability of new

and innovative business and information services.

The customer uses the menu pages to enter name, address, and

phone information, along with orders for pizza and beverages. The

order is then transmitted via the Internet back to Wichita, and

then relayed via modem and conventional phone lines to the SCO

Open Server system at the customer's nearest Pizza Hut

restaurant. The local restaurant can then telephone first-time

users to verify orders. All money changes hand at the point of

delivery.

"Pizza Hut already runs home delivery applications on SCO Open

Server at over 1,000 restaurants, and that makes it relatively

easy to integrate this new application into their operations for

the pilot," said Doug Michels, SCO's Executive Vice President and

Chief Technical Officer. "The primary challenge was to create a

graphical menu page that makes it easy and convenient for

customers to order pizza. The Mosaic component of the SCO Global

Access product provided the ideal set of graphical tools needed

for this application."

About SCO Global Access

The SCO Global Access product family provides the foundation for

businesses to develop integrated Internet server solutions. The

Global Access family consists of a supplement for SCO Open Server

systems as well as an integrated desktop product for testing the

waters of the Internet.

Santa Cruz Internet users can access PizzaNet by entering

http://www.pizzahut.com. To obtain more information on SCO via

the Internet, enter http://www.sco.com.

Pizza Hut, a subsidiary of PepsiCo., is the world's largest pizza

distribution company, with more than 8,200 restaurants and

delivery units in the U.S. and more than 2,500 units in 87

countries. Voted "Best Pizza Quality" in a Restaurant &

Institutions consumer poll, Pizza Hut is the recognized leader of

the $17 billion dollar pizza category.

SCO is the world leader for UNIX servers (Source: IDC 1994).

Businesses and governments use SCO Open Systems Software to run

their critical operations, accessing information across local,

national, and international boundaries and networks. SCO sells

and supports its products in more than 80 countries through a

worldwide network of distributors, resellers, systems

integrators, and OEMs.

SCO, the SCO logo, The Santa Cruz Operation, Open Desktop, and

Open Server are trademarks or registered trademarks of The Santa

Cruz Operation, Inc. in the U.S.A. and other countries. All other

brand or product names are or may be trademarks of, and are used

to identify products or services of, their respective owners.

I know. It's so cute and quaint. But if you think about it, what Me Inc. seems to do isn't that far off in concept from this old plan, is it? So whether this is the same as SCO Global, or is a part of it, and another part is the services offerings, I don't know. This is what I've found, and no doubt someone out there will know. Update: Services in connection with Me Inc. as the reason why SCO Global comes into the sale makes sense in light of this recent press release from SCO and Franklin Covey:

FranklinCovey and The SCO Group Form Strategic Relationship to Bring Collaborative Mobile Planning Tools to Market

SALT LAKE CITY, April 22 /PRNewswire/ -- FranklinCovey (NYSE: FC), a global leader in effectiveness training, productivity tools and assessment services, and The SCO Group (Pink Sheets: SCOXQ.PK) a leading provider of UNIX software technology and mobile services announced today that they have formed a strategic relationship to market, sell and distribute new collaborative mobile planning tools developed by Me Inc., a wholly owned subsidiary of The SCO Group.

The tools, which feature Me Inc. mobile technology, will provide users with real-time access to plan and coordinate schedules, track goals, set appointments, manage and delegate tasks and utilize multimedia, all from their smart phone or PC client. The first round of new products will be available in early summer.

"FranklinCovey is pleased to enter into this agreement with Me Inc., to bring our customers new and powerful mobile planning tools that improve individual and business productivity," said Jeff Anderson, senior vice president, product management at FranklinCovey. "Me Inc.'s technology helps to fill the growing demand in the marketplace for effective mobile technologies that improve personal and group productivity rather than complicate it. The more we have worked with this collaborative product, the more convinced we are of its capability to move the needle for consumers and professionals looking for next generation mobile solutions."

Our subsidiary, Me Inc., has been working for a number of years on developing mobile technologies that help individuals and businesses take greater control over their lives and improve their effectiveness, whether at work, at home or on the go, all from the palm of their hand," said Jeff Hunsaker, president and chief operating officer of SCO Operations. "We identified FranklinCovey as the industry leader in providing tools and training for increasing personal and professional effectiveness and are excited about their stated vision and commitment to bring this product to market. We believe this partnership will be very beneficial to both companies and look forward to announcing and rolling out this new and unique mobile technology very soon."

Yet, if they need to outsource services, what services group would be useful to sell? Perhaps all they want is the name, since I recall Stephen Norris and Jeff Hunsaker mentioning that what attracted them was the future services possibilities in connection with global customers: "Not only will this deal position us to emerge from Chapter 11, but it also marks an exciting future for our business," said Jeff Hunsaker, President and Chief Operating Officer of SCO Operations. "This significant financial backing is positive news for SCO's customers, partners and resellers who continue to request upgrades and rely upon SCO's UNIX services to drive their business forward."

SNCP has developed a business plan for SCO that includes unveiling new product lines aimed at global customers. This reorganization plan will also enable the company to see SCO's legal claims through to their full conclusion.

"We saw a tremendous investment opportunity in SCO and its vast range of products and services, including many new innovations ready or soon to be ready to be released into the marketplace," said Stephen Norris, managing partner for SNCP. "We expect to quickly develop these opportunities, and to stand behind SCO's existing base of customers and partners." I can see the name alone, not to mention the customer lists, having value in that connection. End Update.] What is clear is that whatever SCO Global is, SCO thinks it is part of whatever it would like to sell, or at least tell the court it would like to sell. We see that pointblank in the dropped York deal, but this bill from Dorsey & Whitney is talking about March. The York deal was a dead duck by then.

Clearly there was and is a plan SCO Global is part of, but it hasn't come into full relief to us outsiders yet. But we are watching it form, bit by bit, in these monthly bills and in the reorganization proposals. It seems odd that a company can be in bankruptcy, and there is so little known or readily available about what its subsidiaries do.

Another detail from the bill - the payments

If you look at the order authorizing Dorsey & Whitney to serve as SCO's Special Counsel [PDF], it says Dorsey is to do regulatory and corporate stuff, and it can work on the prior litigation, but it is not to handle the bankruptcy. They can advise SCO's bankruptcy team, but they are not allowed to represent SCO in the bankruptcy.

Exhibit D gives the breakdown of what tasks they handled for SCO in this particular time period, and as you'd expect, it's corporate stuff, like SCO's appointing Jeff Hunsaker to be the President of SCO Operations, and meetings of the compensation committee, that sort of thing.

A six monthly bill is a milestone in bankruptcy court, I gather, since there is a special 6th Monthly Notice required. This month, they'd like $21,693.25, plus $895.56 in expenses. Prior monthly bills went like this, first the ones approved in full:

9/14/07-10/31/07 - $57,585.75 - Expenses: $6,129.29

11/1/07-11/30/07 - $26,456.50 - Expenses: $527.93

12/1/07-12.31.07 - $12,568.50 - Expenses: $1,735.12

Then the next two bills were approved in part, so far:

1/1/08-1/31/08 - $22,799.25 ($18,239.40 approved) - Expenses: $276.15

2/1/08-2/29/08 - $53,966.00 (43,172.80 approved) - Expenses: $745.61 Why is there that difference, I wondered?

On page 5 of this Application, it states that the court authorized applications on an interim basis, on notice to everyone who might object, and if they don't object within 20 days, then they can file a Notice of No Objection with the court, and then after that, SCO can pay the following: Upon expiration of the Objection Deadline, the Professional may file a certificate of no objection with the Court after which the Debtors are authorized to pay each professional an amount ... equal to the lesser of (i) 80 percent (80%) of the fees and 100 percent (100%) of the expenses requested in the Monthly Fee Application... and (ii) 80 percent (80%) of the fees and 100 percent (100%) of the expenses not subject to an objection, unless an objection has been lodged against specific fees and/or expenses or the Court orders otherwise.

The Administrative Order [PDF], which issued on October 4, 2007, says the same thing on page 3, that all the professionals should get 80%. So why did Dorsey & Whitney get 100% until the end of December of 2007? I believe it's because of this wording in paragraph 2 on page 2:

Except as may otherwise be provided in other orders of this Court authorizing the retention of specific professionals, all Professionals in these cases shall seek interim monthly payment of Compensation in accordance with the following procedures... So we need to look to the retention order [PDF] which approved Dorsey & Whitney as Special Counsel -- on November 19, 2007, nunc pro tunc back to the petition date on September 14. And in fact, on page 3 of that retention order, it says this: ORDERED that, in its first noticed monthly fee application, Dorsey shall seek to and, if authorized pursuant to the applicable procedures relating to professional fee applications, may apply the Retainer to the Unbilled Claim, and thereafter, Dorsey shall apply the remainder of the Retainer to the final fees and expenses approved on an interim basis for payment pursuant to procedures in place relating to the allowance and payment of professional fees...

If you look at SCO's Initial Monthly Operating Report [PDF], on page 33, we find that indeed Dorsey & Whitney were paid a retainer on September 11, 2007 in the amount of $100,000. That's on the eve of the bankruptcy, which makes it all in the clawback category, at least in theory. I gather it took Dorsey until the end of December to work through that pile of cash, after which it began to bill under the process in place for all professionals, 80% interim payments. One final note. If you look at the breakdown of who is paid at what rate at Dorsey & Whitney, on page 8 of the PDF of Exhibit D, we see a J. Hamilton, Trainee, being paid at what seems a rather high rate, $310/hour, higher than D. Marx, Associate, at $270/hr. That seems strange. Perhaps it's a mistake. Either that, or he or she is being trained as a partner. Kidding.

|

|

|

|

| Authored by: ais523 on Wednesday, May 14 2008 @ 04:19 AM EDT |

| Please place the correction in the title, if it fits. [ Reply to This | # ]

|

- Syntax error - Authored by: Anonymous on Sunday, May 18 2008 @ 08:22 AM EDT

| |

| Authored by: Erwan on Wednesday, May 14 2008 @ 04:37 AM EDT |

Please quote the article's title.

---

Erwan[ Reply to This | # ]

|

- JavaFX as Rich Internet Application Platform - Authored by: Anonymous on Wednesday, May 14 2008 @ 04:53 AM EDT

- Re: KDE 4.1 Alpha (not very impressive)! - Authored by: Anonymous on Wednesday, May 14 2008 @ 09:18 AM EDT

- Criticism is needed, but the location may not be a good one. - Authored by: Kilz on Wednesday, May 14 2008 @ 10:22 AM EDT

- Re: KDE 4.1 Alpha (not very impressive)! - Authored by: JamesK on Wednesday, May 14 2008 @ 11:18 AM EDT

- Re: KDE 4.1 Alpha (not very impressive)! - Authored by: DarkPhoenix on Wednesday, May 14 2008 @ 11:21 AM EDT

- Re: Kipi Plugins, desktop, etc.. - Authored by: Anonymous on Wednesday, May 14 2008 @ 11:33 AM EDT

- Keeping the Old... - Authored by: Anonymous on Wednesday, May 14 2008 @ 12:49 PM EDT

- Re: Kipi Plugins, desktop, etc.. - Authored by: alisonken1 on Wednesday, May 14 2008 @ 04:07 PM EDT

- Re: Kipi Plugins, desktop, etc.. - Authored by: DarkPhoenix on Wednesday, May 14 2008 @ 06:38 PM EDT

- Re: Kipi Plugins, desktop, etc.. - Authored by: DarkPhoenix on Wednesday, May 14 2008 @ 11:33 PM EDT

- Starting points - Authored by: Anonymous on Wednesday, May 14 2008 @ 01:02 PM EDT

- Starting points - Authored by: jaxad0127 on Wednesday, May 14 2008 @ 02:08 PM EDT

- fvwm ownz ju! - Authored by: grouch on Wednesday, May 14 2008 @ 02:43 PM EDT

- Right on! - Authored by: Anonymous on Wednesday, May 14 2008 @ 03:47 PM EDT

- Right on! - Authored by: Anonymous on Wednesday, May 14 2008 @ 04:57 PM EDT

- Right on! - Authored by: wal on Wednesday, May 14 2008 @ 05:18 PM EDT

- Right on! - Authored by: grouch on Wednesday, May 14 2008 @ 07:22 PM EDT

- Right on! - Authored by: wal on Wednesday, May 14 2008 @ 09:54 PM EDT

- Right on! - Authored by: grouch on Wednesday, May 14 2008 @ 06:59 PM EDT

- Right on! - Authored by: Anonymous on Wednesday, May 14 2008 @ 08:42 PM EDT

- A positive proposal for fixing the problem - Authored by: RTH on Wednesday, May 14 2008 @ 11:28 PM EDT

- I think you are right. - Authored by: Anonymous on Thursday, May 15 2008 @ 12:59 AM EDT

- gtkam... oog - Authored by: Anonymous on Thursday, May 15 2008 @ 01:42 PM EDT

- gtkam... oog - Authored by: Anonymous on Thursday, May 15 2008 @ 03:55 PM EDT

- gtkam... oog - Authored by: Anonymous on Thursday, May 15 2008 @ 08:30 PM EDT

- gtkam... oog - Authored by: Anonymous on Friday, May 16 2008 @ 10:35 AM EDT

- I think you are right. - Authored by: Anonymous on Saturday, May 17 2008 @ 12:22 AM EDT

- A positive proposal for fixing the problem - Authored by: Anonymous on Thursday, May 15 2008 @ 01:04 AM EDT

- I think you mean to say: working directory. - Authored by: billyskank on Thursday, May 15 2008 @ 07:45 AM EDT

- This was in KDE's plan for 4 - Authored by: jeevesbond on Thursday, May 15 2008 @ 02:18 PM EDT

- A positive proposal for fixing the problem - Authored by: jonathon on Thursday, May 15 2008 @ 06:44 PM EDT

- I could have written that - Authored by: baomike on Thursday, May 15 2008 @ 10:47 AM EDT

- As a snobbish old-line Unix user - Authored by: SpaceLifeForm on Thursday, May 15 2008 @ 01:47 PM EDT

- fvwm ownz ju! - Authored by: DarkPhoenix on Wednesday, May 14 2008 @ 06:40 PM EDT

- fvwm ownz ju! - Authored by: Anonymous on Wednesday, May 14 2008 @ 09:07 PM EDT

- Try telling that to young people nowdays, and they *wouldn't* believe you! (nt) - Authored by: Anonymous on Wednesday, May 14 2008 @ 10:20 PM EDT

- Starting points - Authored by: DarkPhoenix on Wednesday, May 14 2008 @ 06:35 PM EDT

- Starting points - Authored by: Fredric on Thursday, May 15 2008 @ 04:34 PM EDT

- Re: KDE 4.1 Alpha (not very impressive)! - Authored by: Jeff Strehlow on Wednesday, May 14 2008 @ 04:30 PM EDT

- Re: KDE 4.1 Alpha (not very impressive)! - Authored by: Anonymous on Wednesday, May 14 2008 @ 11:26 AM EDT

- Re: KDE 4.1 Alpha (not very impressive)! - Authored by: PJ on Wednesday, May 14 2008 @ 12:22 PM EDT

- It's a rebuild from the ground up - Authored by: jeevesbond on Wednesday, May 14 2008 @ 02:58 PM EDT

- Verizon Wireless to introduce Linux phones - Authored by: Holocene Epoch on Wednesday, May 14 2008 @ 11:59 AM EDT

- News Picks Discussions here. - Authored by: Anonymous on Wednesday, May 14 2008 @ 01:08 PM EDT

- News Picks Discussions here. CIO Exclusive: Behind the RGI Scandal: a Letter - Authored by: Anonymous on Wednesday, May 14 2008 @ 01:23 PM EDT

- Java to be under GPL2 - Authored by: halfhuman on Wednesday, May 14 2008 @ 01:37 PM EDT

- Limpopo bobo hej - Authored by: Anonymous on Wednesday, May 14 2008 @ 03:31 PM EDT

- BMW - PC in car standard. - Authored by: Anonymous on Thursday, May 15 2008 @ 08:02 AM EDT

- MS Vs. Yahoo Proxy Battle, Round II - Authored by: CowboyCapo on Thursday, May 15 2008 @ 12:27 PM EDT

- Viacom Versus Fair Use - Authored by: tknarr on Thursday, May 15 2008 @ 12:41 PM EDT

- Action-Reaction Should Be Patentability Test - Authored by: say_what on Thursday, May 15 2008 @ 02:17 PM EDT

- Microsoft's Mundie talks up tech for poor nations - Authored by: Anonymous on Thursday, May 15 2008 @ 05:33 PM EDT

- Interview of Richard Stallman - Authored by: kh on Thursday, May 15 2008 @ 06:09 PM EDT

- OLPC - Stick a Fork in It. - Authored by: psherma1 on Friday, May 16 2008 @ 01:49 AM EDT

- Bill Gates: Microsoft CEO Summit 2008 Speech - Authored by: Anonymous on Friday, May 16 2008 @ 01:50 AM EDT

- Microsoft, OLPC officially team up - Authored by: nitrogen on Friday, May 16 2008 @ 01:54 AM EDT

- Bill Gates' Speech - Authored by: Anonymous on Friday, May 16 2008 @ 02:12 AM EDT

- Microsoft and One Laptop per Child Partner to Deliver Affordable Computing to Students Worldwide - Authored by: Anonymous on Friday, May 16 2008 @ 07:55 AM EDT

- OOKSmell Closed Orifice - Authored by: Anonymous on Friday, May 16 2008 @ 09:38 AM EDT

- Does anti-OOXML noise matter? - Authored by: Anonymous on Friday, May 16 2008 @ 12:00 PM EDT

| |

| Authored by: Anonymous on Wednesday, May 14 2008 @ 04:39 AM EDT |

The FFII is reporting:

European Commissioner McCreevy is pushing

for a bilateral patent treaty with the United States. This Tuesday 13 May in

Brussels, White House and European representatives will try to adopt a tight

roadmap for the signature of a EU-US patent treaty by the end of the year. Parts

of the proposed treaty will contain provision on software patents, and could

legalise them on both sides of the Atlantic.

http://lwn.net/Articles/282000/[ Reply to This | # ]

|

| |

| Authored by: Erwan on Wednesday, May 14 2008 @ 04:39 AM EDT |

As usual. Remember that some like clickies.

---

Erwan[ Reply to This | # ]

|

- The Hague Declaration - Digistan - Authored by: Anonymous on Wednesday, May 14 2008 @ 09:20 AM EDT

- Clickies - Authored by: Anonymous on Friday, May 16 2008 @ 11:20 AM EDT

- U.K. judges go for 'funkier' appearance - Authored by: JamesK on Wednesday, May 14 2008 @ 11:32 AM EDT

- Question about confidentiality. Trying to figure out Open Solaris vunerability. - Authored by: Anonymous on Wednesday, May 14 2008 @ 12:25 PM EDT

- eBay vs. Craigslist - Authored by: Anonymous on Wednesday, May 14 2008 @ 03:06 PM EDT

- sneaky new M$ maneuver - Authored by: lordshipmayhem on Wednesday, May 14 2008 @ 05:22 PM EDT

- Fedora 9 - Authored by: digger53 on Wednesday, May 14 2008 @ 09:19 PM EDT

- Viacom Versus Fair Use - Authored by: nerd6 on Thursday, May 15 2008 @ 01:07 AM EDT

- Yahoo under attack - Authored by: SpaceLifeForm on Thursday, May 15 2008 @ 02:05 AM EDT

- Why Do People Make Odd Statements? - Authored by: DarkPhoenix on Thursday, May 15 2008 @ 04:15 AM EDT

- Shape Shifting Malware Hits the Web - Authored by: Bill R on Thursday, May 15 2008 @ 10:55 AM EDT

- OT: Puppet countries leaves P membership - Authored by: Ted Powell on Thursday, May 15 2008 @ 12:11 PM EDT

- RIAA will have to pay up ... - Authored by: Latesigner on Thursday, May 15 2008 @ 12:18 PM EDT

- Asus to include Linux on all motherboards - Authored by: twhlai on Thursday, May 15 2008 @ 12:52 PM EDT

- So, Does This Mean There Might Be Some Objectivity In The Future? - Authored by: Anonymous on Thursday, May 15 2008 @ 01:49 PM EDT

- Virgin v Thomas - Authored by: Anonymous on Thursday, May 15 2008 @ 01:50 PM EDT

- CBS wastes $1.8 Billion on domain name 'news.com' - Authored by: SpaceLifeForm on Thursday, May 15 2008 @ 02:19 PM EDT

- Former security director blasts OLPC, suggests new strategy - Authored by: SpaceLifeForm on Thursday, May 15 2008 @ 07:59 PM EDT

- Have I missed the Sco/Novell verdict? - Authored by: Anonymous on Friday, May 16 2008 @ 02:59 AM EDT

- Ars Technica analyzes the Bilski appeal - Authored by: nerd6 on Friday, May 16 2008 @ 07:55 AM EDT

- Here's A Cheap Laff For You! - Authored by: Anonymous on Friday, May 16 2008 @ 09:06 AM EDT

| |

| Authored by: kh on Wednesday, May 14 2008 @ 05:08 AM EDT |

If SCO Global is not a part of the bankruptcy then why should SCOXQ.PK pay its

bills?

Do all the subsidiaries of a company in Chapter 11 normally come under

jurisdiction of the BK court or not?

What about if they are not incorporated in the US like the parent?[ Reply to This | # ]

|

| |

| Authored by: Anonymous on Wednesday, May 14 2008 @ 05:15 AM EDT |

Some more background information.

Li

nk1

Link2[ Reply to This | # ]

|

| |

| Authored by: bezz on Wednesday, May 14 2008 @ 06:50 AM EDT |

SCO Global, if it is really all services, is one of the assets they can

probably sell. Support services are not about selling Novell property, but

supporting them. Unfortunately, because subsidiary cash flow is rolled up and

reported under SCO Operations, it is not clear what are its revenues and

expenses or a fair market value. If that is the business, it probably should

survive because there are companies out there with existing service and support

contracts for their legacy SCO products.

I looked through the operating

reports and SEC filings, and most of the other subsidiaries are probably

encumbered with Novell property. For instance, SCO India sells software

encumbered with Novell's SVRX copyrights.

The Me and Cattleback subsidiaries

are probably also salable because there are no Novell assets in those.

Cattleback is the one of most concern, as it was set up to hold a patent. It

sounds like a cynical attempt to unload a patent troll, particularly in light of

Darl's cattle

thieves comment.

SCO Global probably does not present much of a threat

in the long run. But Me and Cattleback, holders of a patent and copyrights, can

be shopped around for their trolling potential. [ Reply to This | # ]

|

| |

| Authored by: Anonymous on Wednesday, May 14 2008 @ 06:58 AM EDT |

Is it possible that the high rate charged for the trainee somehow covers the

"trainer" as well? If I had a trainee dong research for me, I would

want someone more experienced to oversee their work and review their results.[ Reply to This | # ]

|

| |

| Authored by: jmc on Wednesday, May 14 2008 @ 07:26 AM EDT |

It seems that the UK subsidiary is 9 months late in filing its accounts (the

last ones showed assets of about £4).

The last ones (for the year ending

31 October 2006) were due at the end of August 2007 so they will have been fined

for non-compliance.

To see the details go here and look up company number

04738730. Also see the page about fines for non-compliance.

[ Reply to This | # ]

|

| |

| Authored by: bstone on Wednesday, May 14 2008 @ 11:27 AM EDT |

As a fan of SCO products[:-)], I tried to use the Pizza Hut ordering process (to

see if it worked at all). I got what seems to be the worst web page I've ever

seen, so heavily Flash laden that trying to navigate it was nearly impossible.

It did not work at all in Firefox, so I fired up an old Windows machine and

tried to get through it. If you try to register and ask for the Privacy terms,

you can't get back to your filled-in registration form. In Firefox, the screen

just flashes at you trying to display ads, and the text boxes can't be used.

Why would a "Unix company" build something that works only with IE? I

never got it to take an order, even through IE, so I guess I can't give the SCO

back end a try (Not that I really want to order from a menu that doesn't even

give prices).

Oh well, perhaps SCOmobile can come up with a spify interface so I can order

from my cell phone (probably only if I get a Palm Treo). It seems like a good

thing that they didn't attempt to take payment info through a system of that

quality.

[ Reply to This | # ]

|

- Tried Pizza Hut? - Authored by: Steve Martin on Wednesday, May 14 2008 @ 11:41 AM EDT

- Voice Recognition - Authored by: Anonymous on Wednesday, May 14 2008 @ 05:19 PM EDT

- Tried Pizza Hut? - Authored by: Anonymous on Thursday, May 15 2008 @ 12:27 AM EDT

- Not the same site - Authored by: Anonymous on Wednesday, May 14 2008 @ 11:47 AM EDT

- Tried Pizza Hut? - Authored by: red floyd on Wednesday, May 14 2008 @ 01:03 PM EDT

- Pizzahut.com works fine in Mepis... - Authored by: timkb4cq on Wednesday, May 14 2008 @ 02:11 PM EDT

- TERM-pizza - Authored by: Anonymous on Wednesday, May 14 2008 @ 06:15 PM EDT

- Tried Pizza Hut? I did - Authored by: Anonymous on Wednesday, May 14 2008 @ 08:44 PM EDT

- Tried Pizza Hut? - Authored by: Anonymous on Wednesday, May 14 2008 @ 10:57 PM EDT

- Tried Pizza Hut? - Authored by: jto on Friday, May 16 2008 @ 10:29 AM EDT

| |

| Authored by: Anonymous on Wednesday, May 14 2008 @ 12:47 PM EDT |

| SCO can shuffle assets about to suit a particular buyer. What SCO Global has

done in the past may not matter. It can be used simply as a vehicle for

delivering whatever assets a particular buyer wants. If it's already registered

as a company, SCO doesn't have to spend the time and money creating a new

company registration. They simply have to shuffle assets into or out of it

before the sale.

Something that SCO might try to sell off and place into

friendly hands is the license collection business run on behalf of Novell. That

is something that Novell may try to pry out of SCO's hands (breach of contract,

failure to perform, etc., etc.). Novell could ask for this asset back as

part-payment of what SCO owes them.

The license collection business is one

of the foundations of SCO's IP lawsuit business (it gives them the aura of

having the right to act on "behalf of all Unix"). Putting this into friendly (to

SCO) hands would keep them from being just another minor Unix vendor. [ Reply to This | # ]

|

| |

| Authored by: Anonymous on Wednesday, May 14 2008 @ 07:14 PM EDT |

Tell me, does anyone else get the same mental picture when they hear Darl talk

about 'mobility assets'?

I picture those assets as being in large sacks with '$$$ Novell $$$' written on

them into a windowless van marked SCO Global. Those sacks are being carried out

a second-floor window and down a fire escape at night by men wearing masks,

gloves and black hoodies with matching black sweatpants. They're all wearing

black shoes with soft, quiet soles and they're carrying guns and knives where

the blades have been blackened so as not to sparkle.

Does anyone else see that picture when they think about Darl's words?[ Reply to This | # ]

|

| |

| Authored by: argee on Thursday, May 15 2008 @ 10:09 PM EDT |

It seems to me that rather than SCO being a Leading Provider

of UNIX, they could well be dead last. "Also Ran."

There's IBM, SGI, HP, Sun, SCO. Did I miss any?

Maybe we should prick this balloon.

---

--

argee[ Reply to This | # ]

|

| |

| Authored by: bezz on Friday, May 16 2008 @ 12:38 AM EDT |

Me Mobile Services has not been a big seller. It's sales have been so low,

the accounting is not even broken out separately as described at the 341

hearing. SCO Global, the support and services provider, faces a formerly large

but shrinking customer base. Thus, I can see how Global's list of past and

present customers would be valuable in marketing ME's offerings. I'm not sure,

but I think Hipcheck (the systems monitoring software) also falls under ME, as

it is also marketed under Mobile Services. That also ties in to the patent

transferred to Cattleback.

That would conveniently tie together the salable

assets (Global, Me and Cattleback) together under a plausible business model.

Plausible, but challenged.

Me's Shout, Vote and Team mobile services have

some potential, but face an uphill battle in a competitive market. Me operates

on the back-end. It runs as a server-based service to provide application data

to mobile phones running Windows Mobile, Blackberry and Palm operating systems;

additional client software may also be needed on the mobile phone. The Windows

Mobile market is likely limited because that type of phone already is well

integrated with Microsoft Exchange Server. Me could be marketed to enterprises

that are using Blackberry and Palm mobile phone platforms, as those platforms

lack some of the collaborative features the Windows Mobile - Microsoft Exchange

platform already offer. But, there is a lot of competition in that market

space. A list of clients to bother adds value, but how much is hard to

say.

Hipcheck and the Cattleback patent are "valuable" for the patent

trolling potential. However, the patent is going to be vulnerable to prior art

as many proprietary and Open Source monitoring systems are already

available.

How would I, putting myself in the cynical, litigious SCO-World,

market the salable assets? Put together a business model around the client

lists (Global) and Mobile Services (ME, Hipcheck). That has a dollar value. Me

and Hipcheck have a revenue stream, but it is poor. The client list is the

marketing tool to show a potential greater revenue stream from Me and Hipcheck.

But I doubt it has a dollar value sufficient to justify a price that could pay

back Novell damages. The patent trolling potential is the jackpot I would

market for the big bucks.

And what is left of SCO for IBM to go after if it

emerges from Chapter 11? That's right, UnixWare and SVRX. The core asset that

loses money every quarter, has no future and the basis of the claims and

counterclaims in the lawsuits. But now with a pocket full of cash to continue

litigation.

SCO hasn't tried that so far, but it sounds like the nightmare

scenario. Sell the assets unencumbered with Novell copyrights and litigation

loss liability to continue a new patent troll. Fund the existing (and failing)

litigation, but isolate the probable liability to the part of the business

encumbered with Novell copyrights. The wild card for emergence from Chapter 11

is whether the salable assets can command a cash price sufficient to satisfy the

creditors and Novell. So far, the York and SNCP deals suggest not. [ Reply to This | # ]

|

| |

| Authored by: gfolkert on Friday, May 16 2008 @ 09:29 AM EDT |

He was employed by them and still has a buncha contacts in the "ole-Boy

network". So perhaps Darl is gettin' his Golden Parachute

ready.

buncha contacts... hahaha I kill myself. Franklin

Planners... get it? [ Reply to This | # ]

|

| |

| Authored by: Anonymous on Friday, May 16 2008 @ 12:17 PM EDT |

| Novell Inc., the second-largest seller of Linux operating-system software in the

United States, named Richard Crandall to replace Thomas Plaskett as nonexecutive

chairman.

Plaskett will continue to serve on the board of directors, the

Waltham, Mass.-based company said Thursday in a statement. Novell was founded in

Utah and continues to have its largest office in Provo.

Crandall is a

founding managing director of technology venture capital firm Arbor Partners LLC

and chairman of Pelstar LLC, a maker of medical measuring devices. He's also

managing partner of real-estate development firm Alpine Capital Partners

LLC.

Novell teamed up with Microsoft Corp. last month to sell more premium

business software to Chinese companies. The Linux operating system is

open-source, meaning its underlying code is shared freely online. Novell makes

money by offering premium versions of the software, along with related services.

SL Trib [ Reply to This | # ]

|

|

|

|

|